Page 71 - AAGLA-JUNE 2022

P. 71

Member Update

TLoan Options to Combat Rising Interest Rates

By Laura Hertz, Loan Officer, CSMC Mortgage

he housing market is continuing interest for the rest of the loan term, typically at whatever to shift. Home prices are starting the rate exists at the time. Both loan options generally to normalize, and more homes are startoutwithlowermonthlypaymentsandbetterinterest starting to come to market. But the rates, which leaves you with more cash on hand and can be biggest change has been the rise in a great option for real estate investors. Keep in mind when interest rates (interest rates have rates drop again you can refinance.

increased 2.5% since January and may

increase further). This has reduced the number of buyers that qualify for loans, and several people are pondering if this is still a good time to buy. Rates may

drop next year, but historically rates in the 5% range are still good. The continued obstacle is the lack of inventory. Current homeowners with lower interest rates cannot afford to downsize to a lower payment or move up without a great increase in their payment, unless they move out of California.

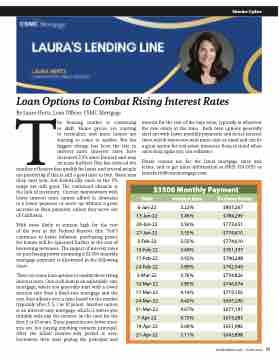

With rates likely to remain high for the rest of the year as the Federal Reserve (the “Fed”) continues to battle inflation, purchasing power for homes will be squeezed further as the cost of borrowing increases. The impact of interest rates on purchasing power assuming a $3,500 monthly mortgage payment is illustrated in the following chart:

There are some loan options to combat these rising interest rates. One such loan is an adjustable-rate mortgage, where you generally start with a lower interest rate than a fixed-rate mortgage and the rate then adjusts over a time based on the market (typically after 3, 5, 7 or 10 years). Another option is an interest-only mortgage, which is where you initially only pay the interest on the loan for the first 5 or 10 years. These payments are lower since you are not paying anything towards principal. After the initial interest-only period is over, borrowers then start paying the principal and

Please contact me for the latest mortgage rates and terms, and to get more information at (805) 724-0755 or laurahertz@csmcmortgage.com.

$3500 Monthly Payment

Date

Interest Rate

Puchase Power

6-Jan-22

3.22%

$807,267

13-Jan-22

3.45%

$784,299

20-Jan-22

3.56%

$773,651

27-Jan-22

3.55%

$774,610

3-Feb-22

3.55%

$774,610

10-Feb-22

3.69%

$761,337

17-Feb-22

3.92%

$740,248

24-Feb-22

3.89%

$742,949

3-Mar-22

3.76%

$754,826

10-Mar-22

3.85%

$746,574

17-Mar-22

4.16%

$719,150

24-Mar-22

4.42%

$697,290

31-Mar-22

4.67%

$677,197

7-Apr-22

4.72%

$673,283

14-Apr-22

5.00%

$651,986

21-Apr-22

5.11%

$643,898

APARTMENT AGE • JUNE 2022 71