Page 83 - AAGLA-MAY 2022

P. 83

Continued from page 80

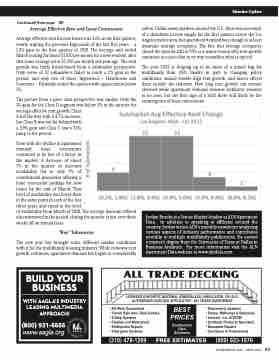

Average Effective Rent and Lease Concessions

Average effective rent for new leases rose 3.6% in the first quarter, nearly tripling the previous high mark of the last five years – a 1.3% gain in the first quarter of 2018. The average unit ended March leasing for about $2,550 per month for a new resident after that same average sat at $2,200 per month one year ago. The rent growth was fairly broad-based from a submarket perspective. Only seven of 32 submarkets failed to reach a 2% gain in the period, and only two of those, Inglewood – Hawthorne and Lancaster – Palmdale ended the quarter with appreciation below 1%.

The picture from a price class perspective was similar. Only the 1% gain for the Class D segment was below 3% in the quarter for average effective rent growth. Class

A led the way with a 4.7% increase,

but Class B was not far behind with a 3.9% gain and Class C saw a 3.1% jump in the period.

Even with the decline in apartment

demand, lease concessions

continued to be less of a factor in

the market. A decrease of about

7% in the quarter in discount

availability led to only 9% of

conventional properties offering a

lease concession package for new

leases by the end of March. That

level of availability was lower than

at the same point in each of the last

three years and equal to the level

of availability from March of 2018. The average discount offered also winnowed in the period, closing the quarter at just over three weeks off an annual lease.

“Key” Takeaways

The new year has brought some different market conditions with it for the multifamily housing industry. While runaway rent growth continues, apartment demand has begun to considerably

BUILD YOUR BUSINESS

WITH AAGLA’S INDUSTRY LEADING MULTIMEDIA APPROACH!

(800) 931-6666

soften. Unlike many markets around the U.S., there was not much of a slowdown in new supply for the first quarter across the Los Angeles metro area, but apartment demand was enough to at least maintain average occupancy. The fact that average occupancy closed the quarter still at 95% is a major reason why rent growth continues at a pace that in no way resembles what is typical.

The year 2022 is shaping up to be more of a mixed bag for multifamily than 2021 thanks in part to changing policy conditions, annual double-digit rent growth, and macro effects from outside the industry. How long rent growth can remain elevated while apartment demand remains lackluster remains to be seen, but the first sign of a shift there will likely be the reemergence of lease concessions.

www.aagla.org

alltradedecking

Jordan Brooks is a Senior Market Analyst at ALN Apartment Data. In addition to speaking at affiliates around the country, Jordan writes ALN’s monthly newsletter analyzing various aspects of industry performance and contributes monthly to multiple multifamily publications. He earned a master’s degree from the University of Texas at Dallas in Business Analytics. For more information visit the ALN Apartment Data website at www.alndata.com.

Member Update

APARTMENT AGE • MAY 2022 83